2022 Financial Crime Examinations Feedback Paper

28 July 2023 | Sharon Avis

The JFSC has published the report from its 2022 Financial Crime Examinations, summarising the main findings from 20 financial crime examinations (18 financial services businesses and two DNFBPs) conducted during 2022. There were 120 findings with just one business having no findings.

If this were a school report, the message would be that supervised persons “must do better”!

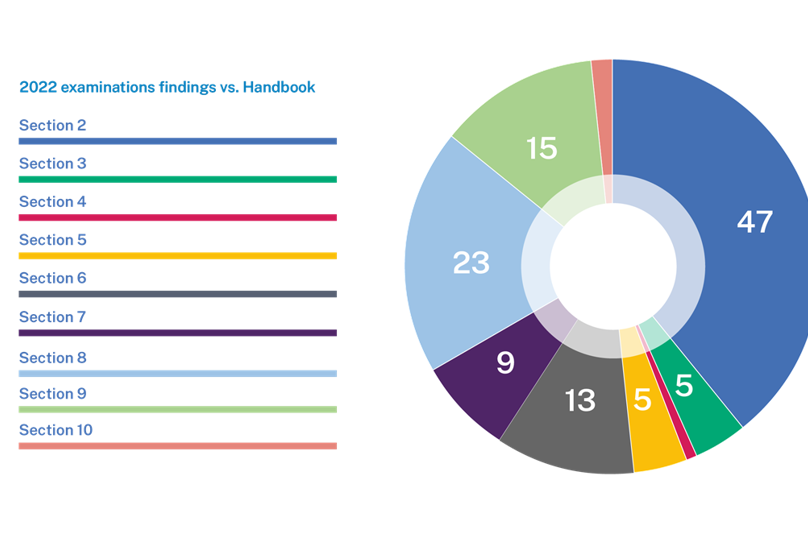

The feedback paper states that of the 120 financial crime examination findings for 2022, 98% fall into four main themes as shown in the table below:

Déjà vu!

As demonstrated by the above table, the JFSC continues to identify repeat themes when undertaking examinations. For a small number of businesses there were findings similar to those highlighted during previous examinations, indicating that action by senior management to address those previous findings had not been effectively implemented or had not fully addressed the root cause of the matter in question.

It is important for all supervised persons to review the findings from the JFSC report and map these findings against the systems and controls they have in place to identify any gaps and/or if any enhancements are required to existing processes.

Where the JFSC identifies repeat findings, indicating that prior remediation has been ineffective or known deficiencies have not been addressed by the board and senior management, these will be considered to be aggregating factors in determining the JFSC’s regulatory strategy with reference to that entity.

The JFSC has also expressed concern with the inability of those supervised persons examined to demonstrate full compliance with statutory or regulatory requirements relating to the reporting of suspicions of financial crime.

Remediation of deficiencies highlighted by examinations

The 2022 examinations identified that, in a small number of instances, the remediation work carried out did not conform to the plan submitted to the JFSC and that, in some cases, remediation had not been completed. Any changes to the previously-agreed remediation plan should have been presented and agreed with the JFSC.

Managing examination findings

Whilst all supervised persons will want to complete an examination without any findings being identified, they should be prepared to manage any findings which are identified. Remediation work must be carefully planned and managed, and supervised persons must ensure that remediation work is targeted to effectively address each finding and the underlying cause of each finding. In this way, as well as returning the supervised person to full compliance, and addressing any root causes, the supervised person will also provide the JFSC with the necessary comfort.

The JFSC published a paper “Guidance on Remediation Action Plans” in April 2023 which should be used as a reference when managing any JFSC examination findings or self-identified issues:

Remediation Action Plans — Jersey Financial Services Commission (jerseyfsc.org)

If you feel that your business could benefit from Cyan’s expertise in designing, implementing and reporting on remediation plans, please get in touch.